KEY HIGHLIGHTS

- Non-binding indicative term sheets signed with St Barbara Limited (“St Barbara”) (ASX: SBM) to:

- wind down and settle the Second Fortune finance facility (“Debt Restructure”); and

- extend the processing arrangement at Gwalia to 31 December 2023 with an option to extend to 30 June 2024 (“Processing Extension”).

- The Debt Restructure includes the settlement of all amounts owed to St Barbara which is to occur on or before 30 June 2023 on the following basis:

- $8.0 million cash payment

- $3.0 million in LGA shares issued at the pre-IPO price of $0.16 per share

- Debt Restructure materially resets LGA’s balance sheet and enables:

- continued delivery of gold from Second Fortune; and

- from early CY24, potential ore production from the Devon JV.

- St Barbara will become a major shareholder with processing to continue at Gwalia under the Processing Extension.

Linden Gold Alliance Limited (“Linden” or “LGA”) is pleased to announce that it has signed non-binding indicative term sheets to implement the Debt Restructure and Processing Extension.

Debt Restructure

St Barbara and LGA have signed indicative terms to settle and wind down the secured Second Fortune finance facility by way of a cash and share settlement payment.

The Debt Restructure includes settling all amounts owed to St Barbara, including $17.9 million senior debt (inclusive of capitalised interest) and $2.8 million in gold in circuit trade debt.

Linden originally borrowed $16 million from St Barbara in December 2020, to redevelop the Second Fortune underground mine. Initial ore production occurred four months later, with first gold poured in April 2021.

Under the terms of the Debt Restructure settlement will occur on or before 30 June 2023 and upon Linden paying the following to St Barbara:

- $8.0 million cash; and

- $3.0 million in LGA shares issued at the pre-IPO price of $0.16 per share.

The above payments will be deemed a complete and full repayment of LGA’s debt to St Barbara and the associated security over LGA and its assets will be released.

Linden will fund the Debt Restructure cash payment from an imminent pre-IPO issuance to sophisticated and wholesale investors, which will include additional funding for growth and working capital uses. The capital raising is to commence this month (May 2023).

Canaccord and Argonaut advised Linden and will act as Joint Lead Managers in respect of the capital raise. Gilbert + Tobin is Linden’s legal advisor.

Processing Extension

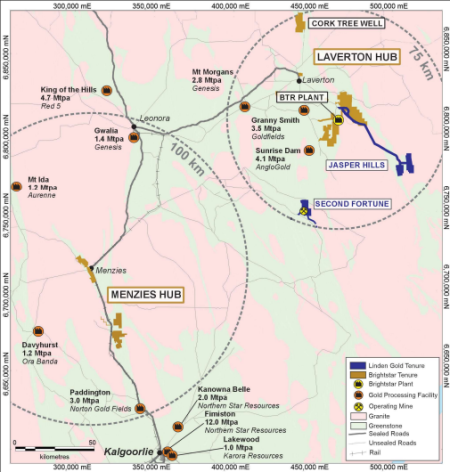

In conjunction with the Second Fortune finance facility, Linden and St Barbara also agreed an ore purchase agreement in December 2020 under which Linden has sold all ore produced from Second Fortune over the past 24 months, totaling over 315 kt yielding more than 36 koz of gold.

St Barbara and LGA have signed indicative terms to extend this processing arrangement to 31 December 2023 with an option to extend to 30 June 2024 subject to further drilling at Second Fortune.

Linden Gold Alliance Managing Director, Andrew Rich commented,

“We wish to thank St Barbara for the continued support and partnership with Linden in indicatively accepting a compromised repayment under the Debt Restructure and an extension of our processing arrangement – we look forward to welcoming St Barbara onto our share register. We expect that the debt reduction, coupled with our recent strong cash generation from operations will increase the investment proposition of Linden and our growth plans ahead of our planned IPO later this year.”