Brightstar Makes Recommended Takeover Offer for Linden Gold Alliance

Linden Gold Alliance Limited (Linden) and Brightstar Resources Limited (ASX:BTR) (Brightstar) have entered into a Bid Implementation Agreement (BIA), pursuant to which Brightstar will acquire all of the issued ordinary shares and options in Linden via an unanimously recommended off-market scrip takeover offer (Offer).

KEY HIGHLIGHTS

- Brightstar Resources Limited (Brightstar) to acquire Linden Gold Alliance Limited (Linden) via unanimously recommended off-market scrip takeover offer (Offer)

- Linden’s Directors unanimously recommend Linden shareholders accept the Offer, in the absence of a superior proposal

- Linden Directors representing 13.2% and Linden’s major shareholders, including St Barbara Limited (St Barbara), representing approximately 67.3% have signed pre-bid agreements with Brightstar or have signed intention statements to accept the Offer in respect of all current Linden shares and Linden options they own and control, in each case in the absence of a superior proposal

- Under the Offer, Linden securityholders are to receive 6.9 Brightstar shares for every 1 Linden share held and 6.9 Brightstar options for every 1 Linden option held, equating to an implied Offer price of 11.04 cents per share

- The Offer implies an undiluted equity value for Linden of approximately $23.7 million

- The Offer is subject to conditions including a minimum 90% acceptance condition by the Linden shareholders and Linden optionholders

- Brightstar has entered into a trading halt to raise up to A$12.0 million at A$0.014 per share via a two-tranche placement (Placement), which is not subject to the Offer being successful

- Strong cornerstone support from Brightstar and Linden’s major shareholders Collins Street Asset Management and St Barbara for a total $4.3 million of the Placement.

- Mining investment house Lion Selection Group (ASX:LSX) have committed to $2 million in the Placement to become a Brightstar shareholder

- Linden Directors Andrew Rich and Ashley Fraser to be appointed as Executive Director and Non-Executive Director respectively of Brightstar at successful completion of the Offer Highly regarded natural resources industry professional Richard Crookes will join the Board of Directors as Independent Non-Executive Chairman subject to the successful completion of the Offer.

- Strengthened pro forma balance sheet ($22m cash and nil debt) provides operational flexibility and allows Brightstar to fast-track the development for the enlarged portfolio of assets

- Brightstar to assume the deferred consideration obligations to the vendors of Lord Byron Mining Pty Ltd to Linden and the contingent payment obligations to St Barbara

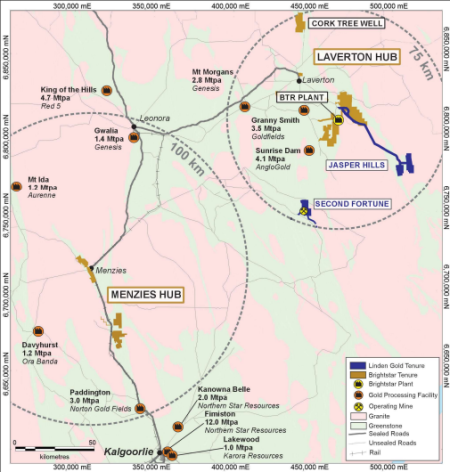

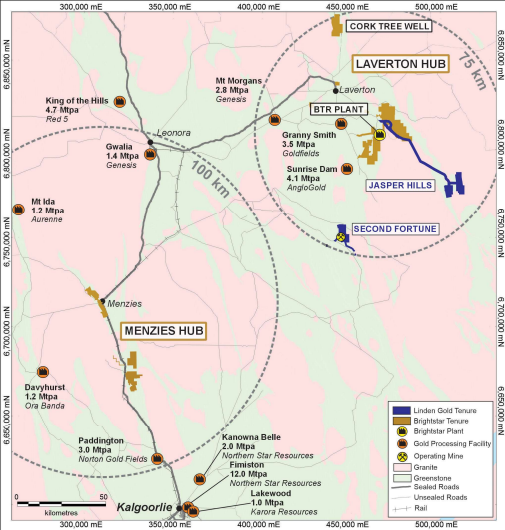

- The combination of Linden and Brightstar will create a gold producer and development company with a material resource base that supports our strategy of becoming a mid-tier gold producer

Linden Gold Alliance Managing Director, Andrew Rich commented,

“On behalf of the Linden Board, we are excited to present Linden shareholders with this compelling Offer. Brightstar’s team and assets are highly complementary to Linden’s, and we believe the combination will unlock material synergies to the benefit of all shareholders. The Offer provides Linden shareholders with a range of benefits, including exposure to a liquid, growing ASX listed gold producer, a strengthened balance sheet and the ability to utilise Brightstar’s existing infrastructure and resource base. The Board of Linden unanimously recommends the Offer and encourages all shareholders to accept the Offer in the absence of a superior proposal.”