KEY HIGHLIGHTS

- Debt restructure with St Barbara Limited (“St Barbara”) is now complete and Linden is now debt free

- St Barbara has been issued a first tranche of shares establishing it as a major shareholder with 19.8%

- Second tranche of shares to be issued to St Barbara subject to a Linden shareholder vote to take St Barbara to ~30%

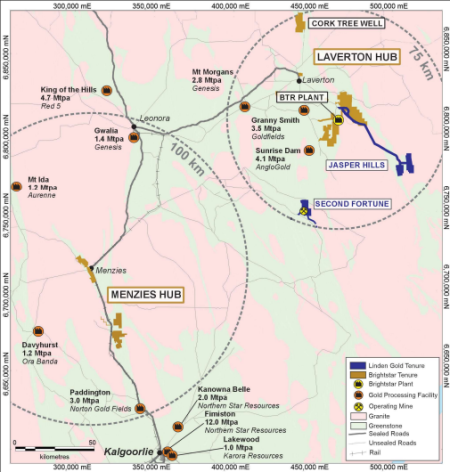

- Linden, with a reset balance sheet, reaffirms its focus on:

- delivery of the Devon DFS due by the end of August 2023;

- continued gold production, mine life extensions and efficiencies at Second Fortune; and

- in-mine and regional exploration and M&A opportunities.

Linden Gold Alliance Limited (“Linden” or “LGA”) is pleased to announce the completion of the debt restructure referred to in its 19 July 2023 announcement “Linden to be Debt Free – St Barbara to become major shareholder” circulated to shareholders on 19 July 2023 (“Debt Restructure”).

Under the terms of the Debt Restructure, Linden agreed with St Barbara that the following agreements and payments would be a deemed full repayment of all amounts outstanding to St Barbara under the Facility Agreement (Completion Items):

- entry into a Contingent Payment Agreement for two contingent cash payments payable as follows:

- $2,500,000 upon 20,000 ounces of cumulative project ounces (100% basis) being mined from the Devon open pit pursuant to the joint venture with Matsa Resources Limited; and

- $2,500,000 upon the earlier of:

- Linden making a new JORC-compliant discovery of 50,000 ounces at a minimum grade of 4.0g/t Au within three years; or

- Linden achieving total Group JORC-compliant Mineral Resources of 500,000 ounces.

- entry into a Share Subscription Agreement for the issue of ordinary LGA shares to St Barbara in two tranches:

- Tranche 1: 14,056,250 shares taking St Barbara’s holding in Linden to 19.8% (issued); and

- Tranche 2: a further 23,443,750 shares taking St Barbara’s holding in Linden to ~30% with shares to be issued subject to a shareholder vote for which Linden has commenced preparation of an independent expert report and a general meeting. The issue of Tranche 2 is excluded as a Completion Item.

All Completion items have been satisfied following Linden and St Barbara having concluded binding agreements for the Contingent Payment Agreement and Share Subscription Agreement and Tranche 1 of the share issuance completed under the Share Subscription Agreement.

Linden is now debt free and the security over it and its assets will be wound down imminently.

Linden Gold Alliance Managing Director, Andrew Rich commented,

“We again thank St Barbara for its support transitioning from senior lender to major shareholder. We look forward to progressing Linden’s plans for its next phase of growth with the platform of a significantly improved balance sheet.”